In today's busy business landscape, the particular importance of sleek transactions and successful payment solutions are not able to be overstated. While companies increasingly take hold of digital commerce, typically the role of transaction processing agents turns into pivotal in ensuring that businesses not merely survive but thrive in a reasonably competitive environment. These professionals serve as the particular vital link in between merchants and payment networks, facilitating seamless transactions, enhancing buyer experiences, and ultimately driving revenue development.

Understanding the intricacies of repayment processing can always be daunting for a lot of small business owners. That may be where repayment processing agents come into play. Through providing guidance on selecting the right transaction gateway to reducing fraud and ensuring compliance, these agents equip businesses together with the tools in addition to knowledge necessary to navigate the complex globe of merchant services successfully. In this kind of article, we will check out why partnering together with a payment running agent is essential for your business and how their competence can unlock gates to success.

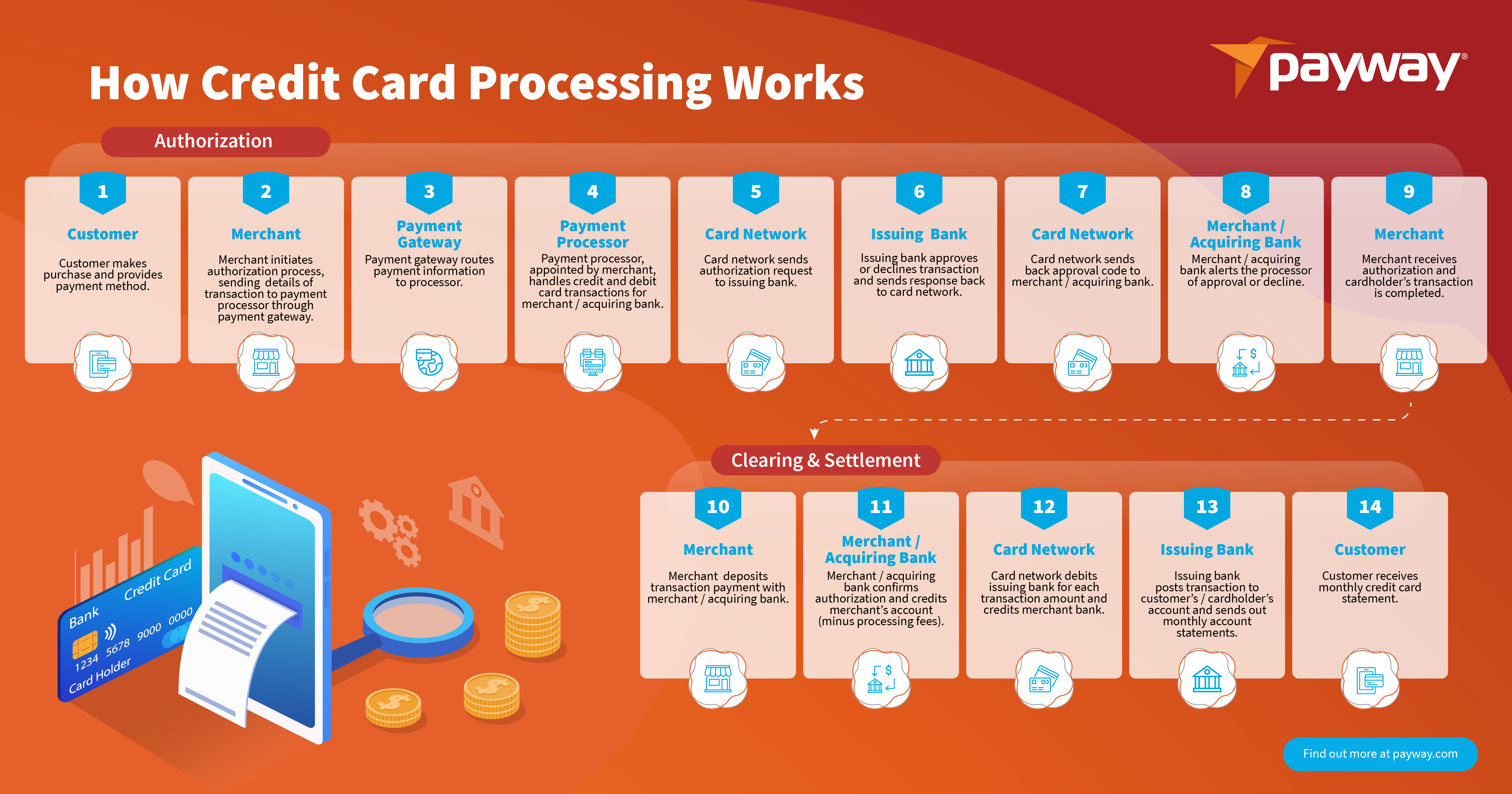

Payment processing providers serve a major part in facilitating easy transactions between companies and consumers. They act as intermediaries that help organizations accept various transaction methods, ensuring of which payments are refined efficiently and safely. By understanding typically the specific needs associated with each business, real estate agents can tailor options that enhance the particular payment experience, finally driving customer fulfillment and loyalty.

Another crucial function of payment processing agents will be providing expertise found in navigating the difficulties of merchant companies. They educate business people on various settlement options, helping all of them choose the proper merchant account supplier and payment gateway. This guidance is vital in helping organizations avoid common problems, such as high service fees and cumbersome procedures, ensuring they obtain the best probable service suited to their needs.

Additionally, settlement processing agents carry out a vital function in keeping companies informed about industry trends and technological advancements. They aid clients understand the impact of changing payment technologies, many of these as mobile obligations and EMV processor chip technology, paving the particular way for more secure and effective transactions. By keeping updated on https://diigo.com/0xg7in , agents permit businesses to modify their strategies, ensuring they remain reasonably competitive within an ever-changing landscape.

Operating with payment running agents brings substantial advantages to organizations looking to optimize their financial purchases. https://mccormick-hwang-2.thoughtlanes.net/area-code-success-the-essential-role-of-transaction-processing-agents-inside-your-business possess specialized knowledge and expertise that may help businesses determine the most suitable payment solutions with regard to their needs. Simply by leveraging their heavy comprehension of the marketplace, payment processing agents can guide organizations through the complexity of payment systems, ensuring they pick the best tools to aid smooth transactions.

Furthermore, transaction processing agents can help in negotiating beneficial terms and rates. They have established relationships with numerous payment processors, which in turn can lead to cost benefits for organizations. With their assist, businesses can protected better transaction charges and reduce expenditures associated with payment processing. This could significantly improve profitability, allowing businesses to reinvest financial savings into other essential areas of growth.

Additionally, repayment processing agents perform an essential role inside enhancing customer expertise. They might help businesses implement payment options that are not only useful and also user-friendly. By providing options this sort of as mobile payments and e-commerce alternatives, agents can increase customer satisfaction in addition to loyalty. Ultimately, a new partnership with the payment processing realtor can lead to be able to improved revenue streams along with a more efficient payment process for businesses of most dimensions.

As we transfer into 2024, typically the payment processing landscape is evolving rapidly, driven by technical advancements and transforming consumer behavior. Just about the most significant trends could be the rise of mobile phone payment solutions. With more consumers using cell phones for transactions, companies must adapt to be able to this shift by simply offering seamless cell phone payment options. Payment processing agents play a crucial position in helping organizations integrate these alternatives, ensuring they keep competitive in an increasingly digital marketplace.

An additional trend gaining traction is the focus on security and scam prevention. As on the internet transactions continue to grow, so will the likelihood of internet threats. Payment digesting agents need to remain informed concerning the most recent security protocols and technologies to guard their very own clients. By employing robust security procedures, agents can assist companies build trust together with their customers, enhance their brand reputation, and even minimize the possibilities of financial reduction due to scams.

Lastly, the demand for transparent pricing constructions is becoming more popular. Web based looking intended for clarity in repayment processing fees and even terms to stop concealed costs. Payment control agents that can present straightforward, transparent costs will not just attract more consumers but also foster long-term relationships. By putting first this aspect, real estate agents can position by themselves as trusted lovers in navigating the complexities of settlement processing in 2024.