Entering the Forex market may feel like walking in a vast and even complex world, specifically for those simply starting their trading journey. With stock markets representing the central source of global trade, the potential with regard to profit is tremendous, but so might be typically the risks. For newcomers, navigating this scenery requires not simply a solid knowledge of the fundamental concepts but in addition effective tactics that can lead in order to consistent success. This particular guide aims to demystify Forex trading, providing a roadmap that empowers newcomers using the essential expertise they need to be able to start their trading endeavors.

From exploring the particular foundational principles of Forex trading to uncovering the very best methods that seasoned dealers swear by, this particular comprehensive resource tackles every aspect the beginner needs in order to consider. We'll dig into the significance of risikomanagement, the nuances of reading forex charts, and the psychological components that can help make or break the trader's success. If you are looking to understand the impact of economic news on the market or perhaps seeking to choose typically the best broker for your needs, this guide serves as your trustworthy companion, paving typically the way to area code the Forex frontier confidently and clearness.

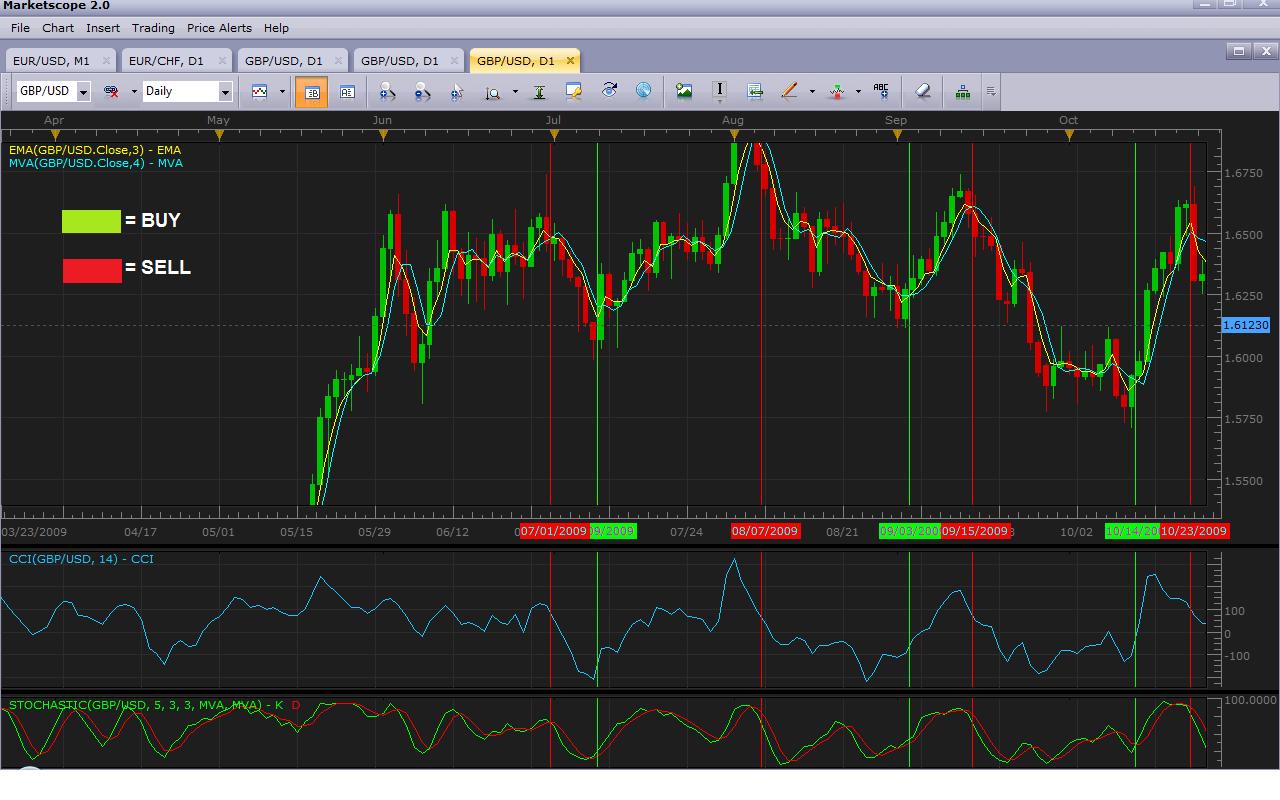

In order to achieve success in Forex trading, it is very important to develop and even implement a variety of effective tactics. One fundamental strategy is to realize and utilize equally fundamental and specialized analysis. Fundamental examination involves assessing financial indicators, rates of interest, in addition to geopolitical events to predict currency moves. On https://bethabesha.com/members/driverlocust45/activity/527065/ , technical analysis centers on historical selling price datand market trends, using chart and indicators to identify potential entry in addition to exit points. Understanding these two methods allows traders to generate informed decisions and enhance their odds of profitability.

Another essential strategy is risk management. Successful traders understand that protecting their capital is just as important as making profits. This particular includes setting suitable stop-loss and take-profit levels, diversifying their particular currency pairs, and even not risking greater than a small percentage of the trading capital about any single trade. A well-defined risk management plan helps reduce potential losses and maintain psychological stability in the course of trading, allowing with regard to a much more disciplined strategy in varying marketplace conditions.

Lastly, it is usually vital to have a solid trading plan set up. Some sort of trading plan describes the trader's aims, strategies, risk ceiling, and guidelines for executing trades. It serves as a new roadmap that will help traders stay targeted and consistent, lessening impulsive decisions powered by emotions these kinds of as fear in addition to greed. By sticking with a structured trading plan, traders can easily systematically approach typically the Forex market, producing adjustments as essential while remaining lined up with their overall objectives for achievement.

In the wonderful world of Forex trading, getting the right tools for your use can considerably boost your trading experience and success. Trading platforms like Mt4 4 and a few are popular among newcomers for their easy to use interface and a wide range of features. These systems allow traders to investigate charts, automate trading using expert advisors, and execute positions with just some sort of few clicks. Moreover, these platforms assistance various indicators and even technical analysis tools that can help traders make well informed decisions.

Another essential tool in a trader's arsenal is a reliable economic calendar. Economic news launches can have a significant influence on currency rates, and being conscious of approaching events is essential with regard to developing effective trading strategies. Traders will use this work schedule to stay current on important announcements like interest charge decisions, Non-Farm Salaries data, and GROSS DOMESTIC PRODUCT figures, which often lead to increased movements in the Forex market. Knowing if to expect these kinds of events allows dealers to adjust their very own positions accordingly, lessening risks and increasing potential profits.

Technical examination techniques also enjoy a vital role in Forex trading. One this sort of technique is using moving averages, which help traders identify styles and potential entry and exit points. By analyzing https://articlescad.com/area-code-the-forex-market-your-ultimate-beginners-guide-to-trading-success-129322.html , traders can decide the overall direction regarding the market, generating it easier to be able to spot trading opportunities. Additionally, tools like Fibonacci retracements in addition to various indicators this sort of as the Family member Strength Index (RSI) provide insights in to market momentum and even help traders make data-driven decisions. Learning these tools plus techniques is vital for virtually any aspiring Forex trader aiming for consistent profits.

One of the particular most prevalent mistakes that beginners make in forex trading is failing to be able to establish a sturdy trading plan. Without having a clear approach, traders often enter and exit jobs based on emotions rather than well-thought-out analysis. This lack of discipline will lead to thoughtless decisions, which commonly lead to significant failures. To stop this pitfall, you will need to create a trading plan of which outlines specific aims, risk management rules, and guidelines with regard to entering and exiting trades.

Another common problem faced by amateur traders is over-leveraging their positions. Whilst leverage can amplify profits, it can easily also exacerbate deficits, leading to quick account depletion. A lot of beginners underestimate the risks associated with higher leverage and ending up trading over and above their means. This is crucial to be able to understand the function of leverage and even use it wisely, making sure your danger exposure remains in a manageable range that aligns with your trading money and risk tolerance.

Eventually, understanding the mental aspects of trading will be vital for long lasting success. Many traders struggle with emotions like fear plus greed, which can cloud judgment plus impact decision-making. Creating a disciplined way of thinking is necessary to stay to your trading plan and withstand the urge to make rash decisions based on market variances. Emphasizing continuous understanding and self-reflection can help you identify emotional activates and cultivate balanced trading approach, thereby improving your odds of success within the forex market.