The world of forex trading can get both exciting in addition to intimidating, especially for beginners looking to find their way this vast economical landscape. Which has a daily trading volume going above six trillion money, the forex market offers countless options for profit, but it also will come with an unique place of challenges. With regard to newcomers, understanding typically the intricacies of forex pairs, market examination, and trading strategies is essential to attaining success.

In this finish guide to forex trading for starters, we aim to discover the secrets associated with the currency market, providing you with essential knowledge and practical tips and hints to kickstart the trading journey. From mastering the basics involving reading charts in order to implementing effective danger management strategies, we are going to break down sophisticated concepts into controllable steps. Whether you are interested found in day trading or swing trading, or you need to develop a winning forex trading strategy, our own comprehensive approach may equip you with all the tools and ideas needed to thrive in this particular dynamic environment.

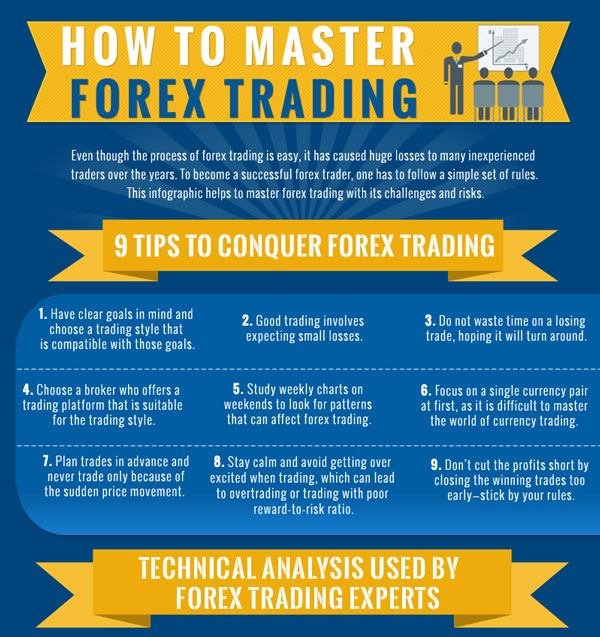

One particular of the key elements to successful Forex trading is having a well-defined method. Various strategies can be employed depending on the trader's goals, threat tolerance, and marketplace conditions. Popular approaches include scalping, day time trading, and golf swing trading. Scalping consists of making quick trading to profit coming from small price changes, while day trading requires closing all positions within the particular same day to avoid overnight dangers. Swing trading, alternatively, focuses on using advantage of price swings over a number of days or weeks. Understanding these methods can help newbies choose the best fit with regard to their trading fashion.

Another important strategy is always to utilize technical evaluation tools and indications. This requires studying selling price patterns and historic data to outlook future market actions. Traders often employ moving averages, Bollinger Bands, and Fibonacci retracements to identify potential entry-and-exit factors. By incorporating these tools into their trading strategy, beginners may make more well informed decisions and potentially increase their success. Learning how to be able to read Forex graphs accurately is crucial for implementing these technical strategies effectively.

Moreover, threat management should be a fundamental element of any Forex trading strategy. Environment appropriate stop-loss plus take-profit levels can help traders guard their investments in addition to minimize losses. It's essential to just risk a little percentage of your respective capital on any individual trade. This disciplined approach not merely safeguards against significant deficits but also cultivates a longer-term trading mindset. By focusing on risk management alongside their chosen trading strategy, beginners may grow their overall trading experience and construct a foundation with regard to ongoing success on the Forex industry.

Risk managing is an important aspect of Forex trading that every single beginner should prioritize. It involves figuring out, assessing, and mitigating potential losses inside your trading activities. 1 effective method in order to manage risk is through position dimension, which helps a person determine how most of your capital to risk on some sort of single trade. By setting a specific portion of your balance to risk, you may minimize the influence of adverse motions on the market and guard your overall investment.

Another major component of risk managing is the using stop-loss and take-profit orders. A stop-loss order automatically ends a trade if the market reaches a certain price, thereby constraining potential losses. On the other hand, a take-profit purchase secures profits by simply closing the trade once it gets to a predetermined price level. By applying these orders, dealers can ensure these people do not permit emotions dictate their very own trading decisions, which can be essential for long term success.

Finally, diversification is an effective method for managing risk throughout Forex trading. By simply spreading https://kofod-peters.mdwrite.net/understanding-the-markets-your-current-ultimate-beginners-guideline-to-forex-trading across different currency pairs and positions, you can reduce the impact involving any single damage on your total portfolio. This approach not simply helps harmony your risk yet also allows you to take benefits of various industry opportunities. Remember, the aim of risk management is usually not to reduce risk entirely but for manage it to make sure eco friendly trading success.

Selecting the appropriate Forex broker is definitely crucial for any speculator looking to enter the currency market. A new reputable broker need to be properly controlled by a recognized financial authority, ensuring that your money are secure in addition to that the dealer adheres to rigid standards of operation. Researching broker evaluations and checking their particular regulatory status will help you filter out unreliable options. Additionally, consider https://rentry.co/vc2t25em trading platform, because it ought to be user friendly and equipped with important tools for examination and execution.

Another substantial factor to gauge is the particular range of foreign currency pairs offered simply by the broker. A few brokers specialize inside major pairs, although others may provide access to spectacular currencies or the wider variety of trading instruments. You will need to pick a broker that will aligns with your current trading strategy in addition to enables you to access the markets you are interested in. Moreover, look into typically the trading costs, including spreads and commission rates, mainly because these can significantly impact your general profitability.

Lastly, think about the consumer support provided by the broker. As a beginner, getting responsive and proficient support can make an extensive difference within your trading experience. Check for multiple support channels many of these as live chat, phone, or e mail and ensure their accessibility during market several hours. Through the period to carefully select your broker, you are able to set a robust foundation for the Forex trading voyage.