In today's fast-paced business surroundings, understanding and handling payment processes is essential to achieving accomplishment. As consumers progressively turn to digital procedures for transactions, organizations must adapt to meet these changing personal preferences. This is in which a https://jsfiddle.net/money71/gmot6r1v/ becomes priceless. Using their expertise and insight, payment running agents not just facilitate seamless dealings but also supply essential support that may significantly enhance the business's financial overall performance.

Identifying the right repayment processing partner can be a game-changer for small and large businesses likewise. These agents enjoy a vital part in streamlining transaction systems, ensuring security, and helping businesses navigate complex rules. By collaborating along with a skilled repayment processing agent, entrepreneurs can unlock fresh revenue streams and elevate customer expertise, ultimately bringing about sustained growth and accomplishment.

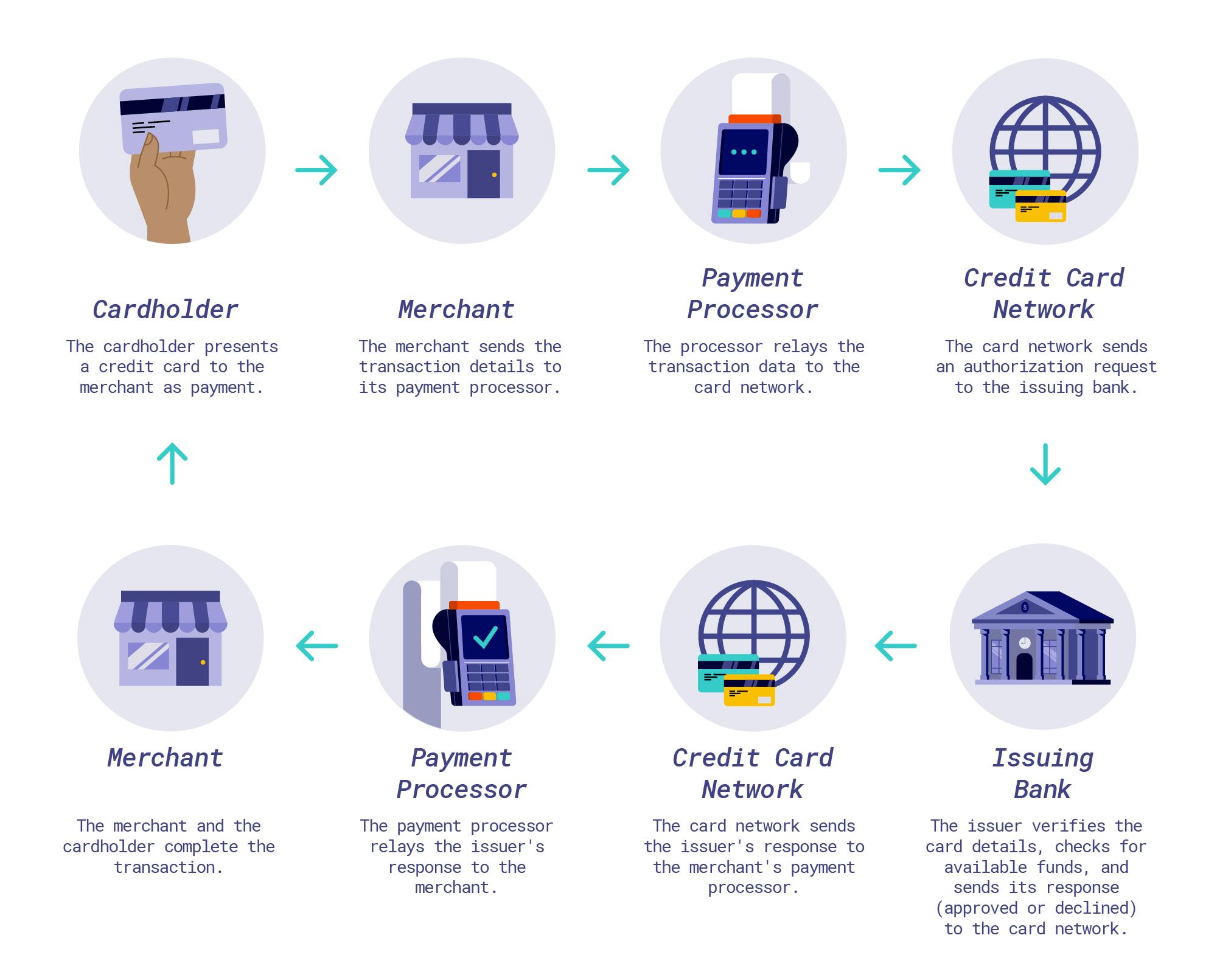

Transaction processing agents participate in a critical position in facilitating soft financial transactions involving businesses and their particular customers. They work as intermediaries that will handle the complex interactions between vendor services, payment gateways, and financial establishments. By giving businesses with the tools needed to accept various payment methods, these agents ensure that transactions are processed efficiently and safely. https://broussard-moses.mdwrite.net/area-code-revenue-the-imperative-role-of-settlement-processing-agents-throughout-your-business allows businesses to focus on their primary operations while mitigating the risks associated with payment processing.

1 of the main functions of settlement processing agents is to help businesses choose the perfect payment solutions customized to their requires. With the vast variety of payment available options, including credit in addition to debit cards, cellular payments, and e-wallets, it can end up being overwhelming for little businesses to identify the best option services. Transaction processing agents have the knowledge in order to analyze a business's specific requirements and even recommend the very best payment gateways and even merchant service providers. This particular guidance not only simplifies the decision-making process but also helps to businesses avoid common pitfalls related to transaction processing.

Additionally, payment control agents continuously keep track of industry trends in addition to regulations to hold their clients informed and even compliant. They enjoy a vital part in educating companies about important elements like PCI complying, interchange fees, plus emerging payment solutions. By staying current around the latest innovations in payment processing, these agents may help businesses conform to changing market conditions and influence new opportunities. As a result, they contribute drastically to the development and success of their clients inside of a rapidly innovating digital landscape.

Payment digesting agents play a crucial role inside helping small organizations succeed by offering tailored solutions that will meet their particular needs. By partnering with a knowledgeable agent, small organization owners can gain access to expert the way to deciding upon the right transaction processing systems that will not only streamline transactions but also improve customer satisfaction. This personalized approach helps to ensure that businesses can provide their customers a seamless shopping experience, which in turn is vital in a competitive industry.

Additionally, payment processing agents can help little businesses keep costs down related with payment running. They understand typically the intricacies of charges, including interchange service fees, and will negotiate better rates with settlement processors for their particular clients. https://rentry.co/o292et2m to secure more affordable rates directly plays a part in higher profit margins, allowing small companies to allocate more resources toward progress and innovation somewhat than overhead costs.

Moreover, a payment handling agent can enhance a small business's capacity to accept numerous payment methods, which include mobile payments in addition to e-commerce solutions. Mainly because consumer preferences switch towards digital transactions, having multiple payment options available becomes essential for attracting in addition to retaining customers. Agents not only facilitate the implementation of such technologies but in addition educate small enterprise owners on just how to leverage all of them effectively to increase revenue and improve overall business performance.

Since we look towards the continuing future of payment processing, probably the most prominent trends could be the continued rise of mobile payments. People are increasingly favoring the ease of mobile phone wallets and contactless payment methods. Payment processing agents must be prepared to combine and support these types of technologies, making sure organizations can meet their particular customers' expectations for quick and unlined transactions. Adapting to mobile payment innovations will not only enhance customer experience but also position companies to capture a broader audience.

Another significant pattern is the growing importance on security plus fraud prevention. While digital transactions turn into more prevalent, the threat of cybercrime and data removes increases. Payment running agents must stay informed about typically the latest security technologies and practices, this kind of as encryption plus tokenization, to guard sensitive customer information. Implementing strong security actions will build confidence with clients plus customers, ultimately protecting revenue and manufacturer reputation.

Lastly, the evolution of artificial cleverness and machine mastering in payment running is set in order to revolutionize the sector. These technologies may analyze transaction data to spot patterns, boost payment routing, and even detect fraudulent routines instantly. Payment processing agents should power AI-driven solutions in order to enhance operational efficiency and provide better insights to their very own clients. Embracing these types of advancements will not really only streamline businesses but also make sure that businesses remain competitive in an ever-evolving marketplace.